In this article, we explore how a shift towards stakeholder needs has transformed ESG orientation and reporting from a “nice to have” to a necessity for companies.

We have created a report that summarizes up the key information from the article, interesting data and higlights why ESG is a necessity for today's companies, what benefits it brings and how we can help you.

Download the report here: ESG_Flagship_ENG.pdf

For more information, please contact us.

Introduction: A shift from shareholders to stakeholders

Whereas the “rules of the game” at the time of Milton Friedman’s famous 1970 quote were that companies existed solely to maximize profit for shareholders without much regard for environmental, social and governance (ESG) issues, we now live in a vastly different world. The shift has been described by many as a one “from shareholder to stakeholder capitalism” with the key stakeholders being investors, governments, citizens, and the environment.

There are several reasons for the shift. Our degree of global interconnectedness is higher than ever, meaning pandemics and social movements can spread across the globe overnight. A number of global problems including climate change, water scarcity, deforestation and loss of biodiversity are intensifying and impacting lives in both the developing and developed world. Developments in science and technology have given us more data to understand these problems and their origins than ever before. The United Nation’s Sustainable Development Goals (UNSDGs) have united these problems into an overseeable action plan. Social media and mobile devices have given people across the globe unprecedented access to information. Armed with this information, citizens, investors and governments have begun to put more pressure on companies to act responsibly where traditional shareholder capitalism has failed to do so.

In this article, we explore how this shift towards stakeholder needs has transformed ESG orientation and reporting, also sometimes referred to as Corporate Social Responsibility or Corporate Sustainability, from a “nice to have” to a necessity for companies.

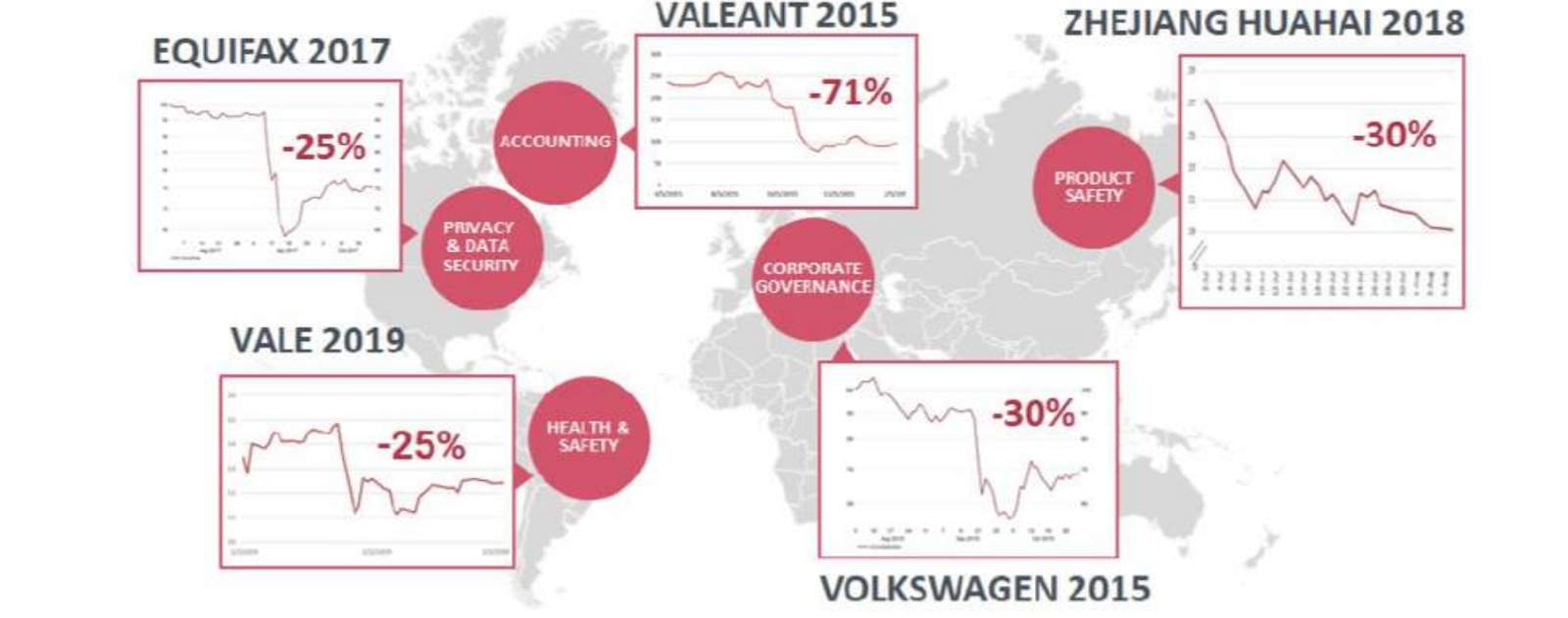

1. Investors are favoring ESG-friendly companies and shunning those involved in ESG scandals

While in 1989, Exxon Valdez spilled 11 million gallons of oil into the Alaskan wilderness and barely experienced any negative impact on its share price, today companies involved in social and environmental scandals are seeing their share prices drop precipitously. After BP’s Deepwater Horizon oil spill in 2010, the company’s share price dropped by 50%. This is proof that shareholders will no longer tolerate poor ESG conduct. Investors are also becoming activists; in 2021, pre-ESG investors successfully replaced three directors at Exxon Mobil in the name of stronger climate action.

Image 1: Shareholders no longer tolerate ESG scandals

Source: HomeCredit ESG Presentation by Jan Ruzicka, Group Chief External Affairs Officer Hong Kong, 2021

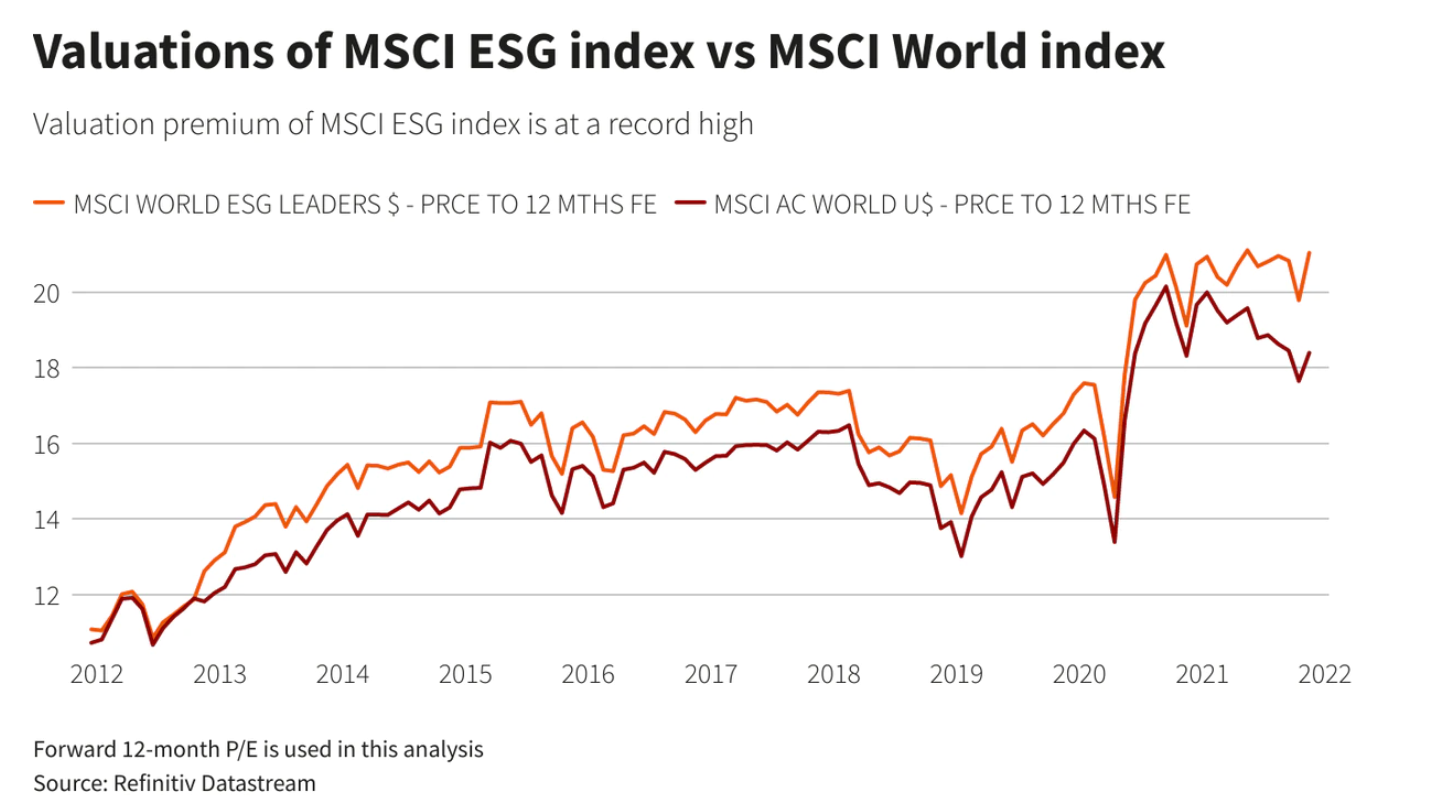

In a 2019 Morgan Stanley survey, 85% of respondents stated that sustainability is becoming more important in their investment decisions. Proving the scale of this movement, a full 10% of global fund assets were invested in ESG funds in 2021. It’s not just that investors have suddenly turned into “do-gooders” – rather, they are acting on strong evidence from thousands of studies that sound ESG practices are strongly correlated with better equity returns. Comparison of the MSCI ESG Leaders with the MSCI World index shows that the ESG-focused index regularly outperforms its traditional parent index, with a smaller downturn during the 2018 financial crisis and significantly better performance in 2021 despite the COVID-19 pandemic.

Source: Reuters, 2021

It perhaps should not be surprising that ESG-focused companies do better in times of crisis. These companies have better factored in environmental and social risks and have cut their operating costs through more efficient technologies. Global companies are showing real evidence that cost savings from implementing strong ESG policies are significant. 3M reportedly saved 2.2 billion USD in a pollution prevention program implemented in 1975 that improved its manufacturing and recycling processes. Fedex has reduced its fuel consumption by more than 50 million gallons, resulting in massive cost reductions.

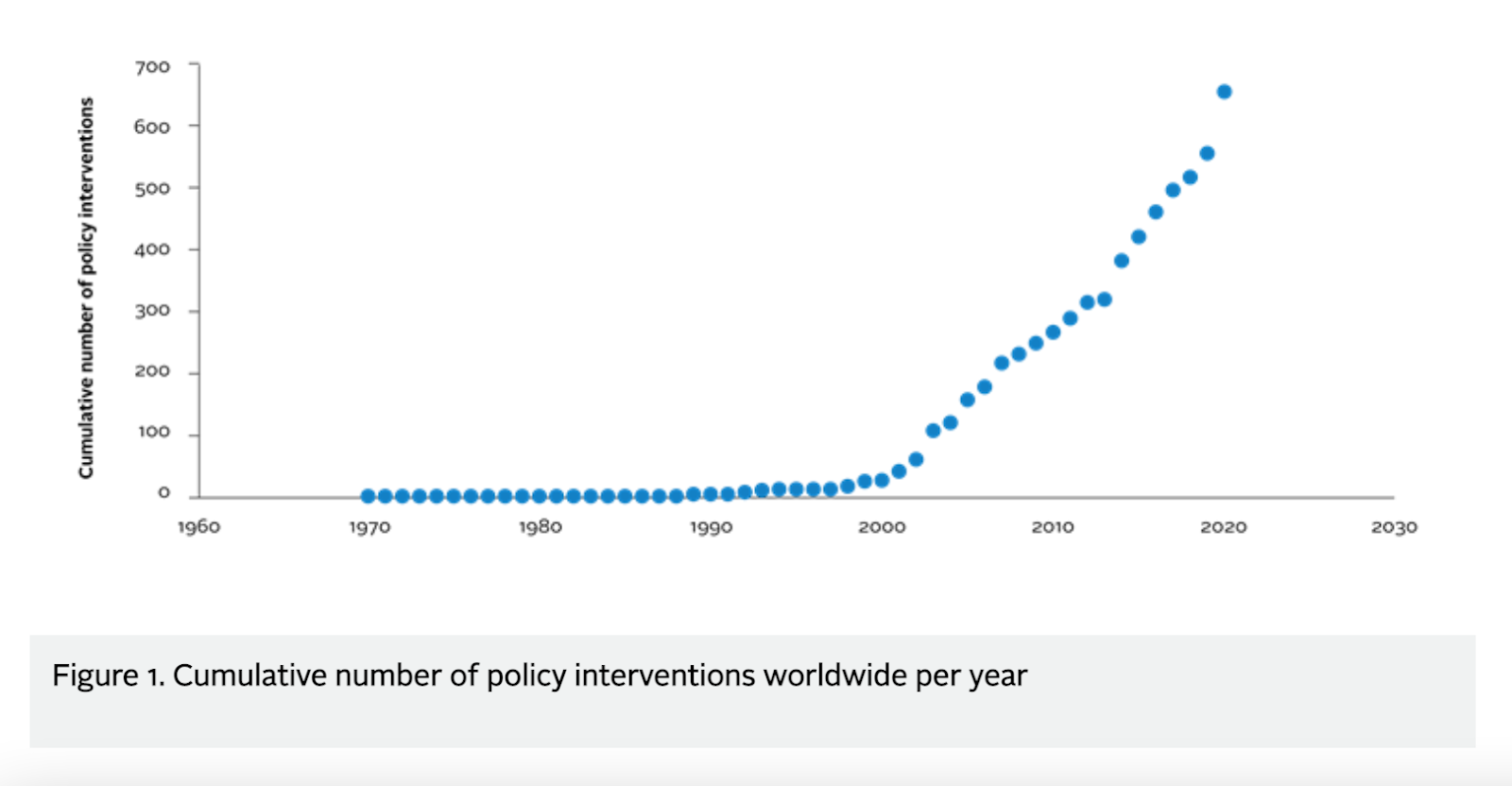

2. Governments are ramping up pressure with an increasing number of ESG policies

In addition to growing pressure from investors, new policies introduced by governments around the world are adding pressure for big companies in the Western world to do ESG reporting. In 2020, 120 new Responsible Investment (RI) policies were introduced worldwide, with Europe leading the way. 2021 saw the introduction of the EU Sustainable Finance Disclosure Regulation (SFDR) and the EU Corporate Sustainability Reporting Directive (CSRD), which will be implemented in the coming years. Under these new regulations, the number of companies required to do ESG reporting in the EU will increase from 11,000 under the old Non-Financial Reporting Directive (NFRD) to 49,000. By complying with these regulations, companies will not only avoid fines but be better positioned to win government support in the form of subsidies and other types of funding.

Source: UNPRI

3. Employees and customers are more willing to work for and buy from ESG-oriented companies

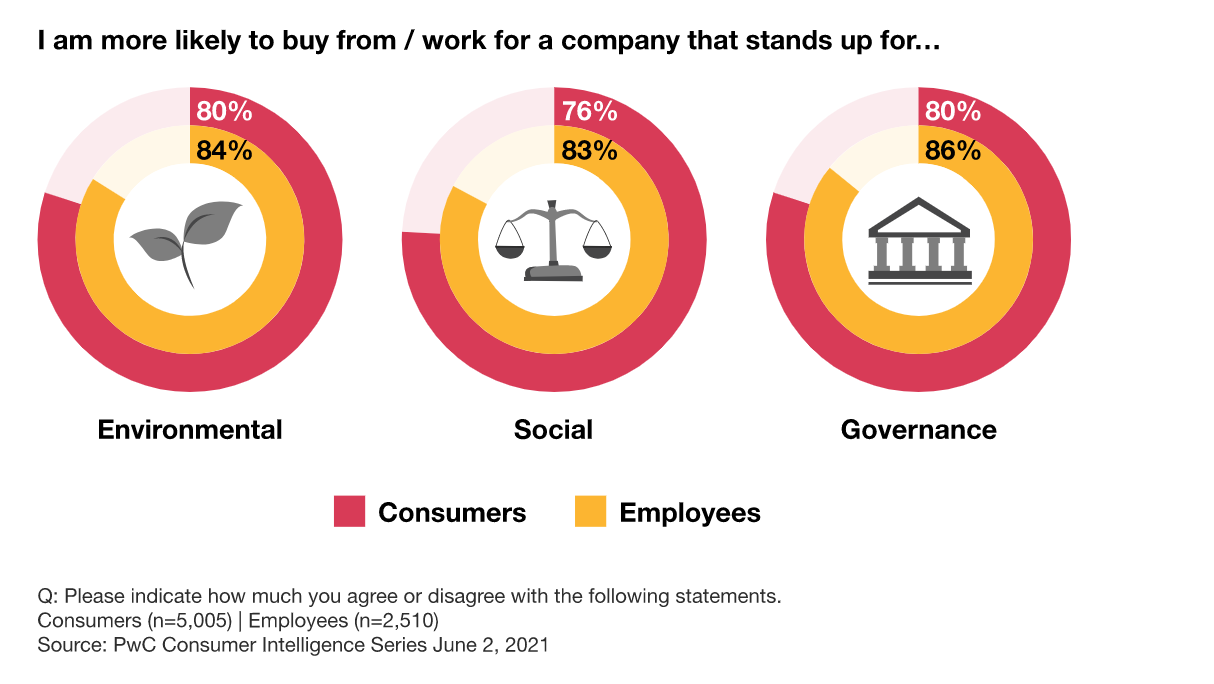

Aside from the increasing regulatory and investor pressure on companies to do ESG reporting, there is a third element of rising scrutiny from citizens: a.k.a. potential employees and customers. With a rise in global crises and upheavals occuring in past years, surveys repeatedly show that people increasingly want to work for and buy from companies they feel have a positive social and environmental impact. This indicates that companies with strong ESG commitments not only will attract the best talent, but are likely to win the loyalty of customers.

Source: PwC Consumer Intelligence Series June 2, 2021

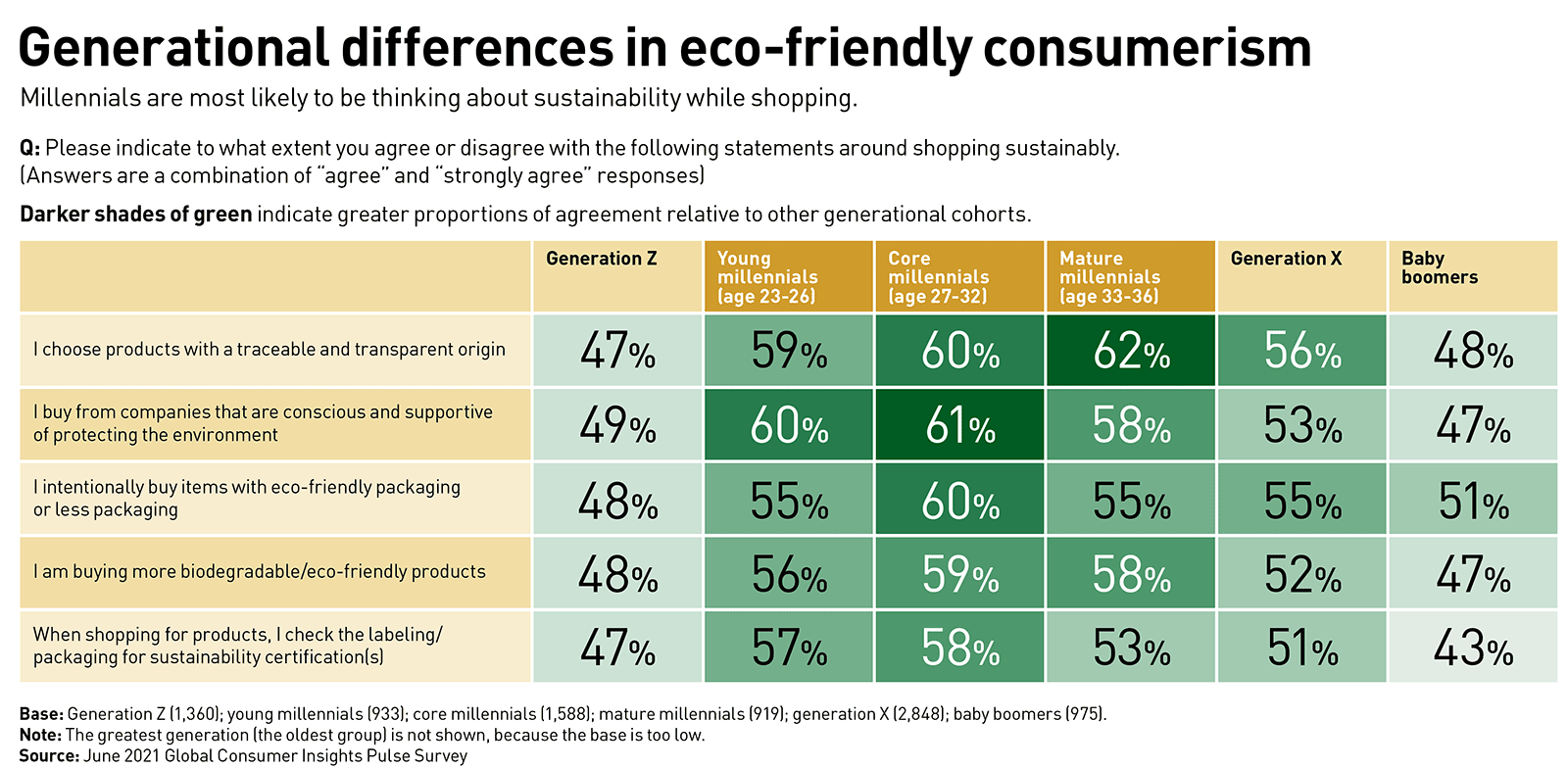

Numerous studies have shown that millennials and women in particular feel very strongly about working for and buying products from companies with sustainable practices. PwC’s 2021 Global Consumer Insights Pulse Survey found that 61% of “core millennials” (age 27-32) prefer to buy from companies that “are conscious andare supportive of protecting the environment.” This matters for business, because both millennials and women are groups of people set to become major inheritors and investors in future.

Source: PwC 2021 Global Consumer Insights Pulse Survey

Conclusion: It’s time to get on board

Companies are responding to this growing pressure from investors, citizens and governments. 80% of companies in the N100, a grouping of the 100 biggest companies in 52 countries, already engage in ESG reporting, according to the 2020 KPMG Survey of Sustainability Reporting. For the world’s 250 biggest companies, known as the G250, this value is at 96%. Given the increasingly mandatory nature of reporting, this number is only set to increase. Yet even in the absence of binding regulations, companies around the world are choosing to report voluntarily given the increasing demands from their stakeholders on all sides. As Google’s CEO Sundar Pichai said in an interview with Bloomberg in 2021, “sustainability is literally on the CEO agenda of pretty much every company we’re working with.”

Now tell us, how has ESG improved your business?